VA loan limits in Hawaii often confuse buyers, but in 2026, most veterans can buy well above county limits with $0 down if they have full VA entitlement.

This guide breaks down how VA loan limits really work, when they matter, and how they apply specifically to Honolulu (Oʻahu), Maui, and the Big Island.

Quick Summary

- VA loans do not have a true loan limit for veterans with full entitlement

- Loan limits only matter if you have partial (impacted) entitlement

- Hawaii’s high home prices often require VA jumbo loans, which can still be $0 down

If you have full VA entitlement, Hawaii VA loan limits won’t restrict how much home you can buy — even in Honolulu or Maui. Limits only affect veterans with an active or previous VA loan.

Key Takeaways

- VA loan limits don’t cap most Hawaii buyers

- Full entitlement = no down payment, even for jumbo homes

- County limits only matter with partial entitlement

- Expert Hawaii-specific guidance can save tens of thousands

Are There VA Loan Limits in Hawaii in 2026?

Short answer: No — not in the traditional sense.

The VA doesn’t cap how much you can borrow. Instead, it limits how much of your loan it will guarantee to the lender (typically 25%).

What most people call “VA loan limits” are actually county conforming loan limits used only when entitlement is partially used.

How VA Loan Entitlement Works

What Is VA Loan Entitlement?

VA entitlement is the portion of your loan that the VA guarantees for the lender. This guarantee allows lenders to offer:

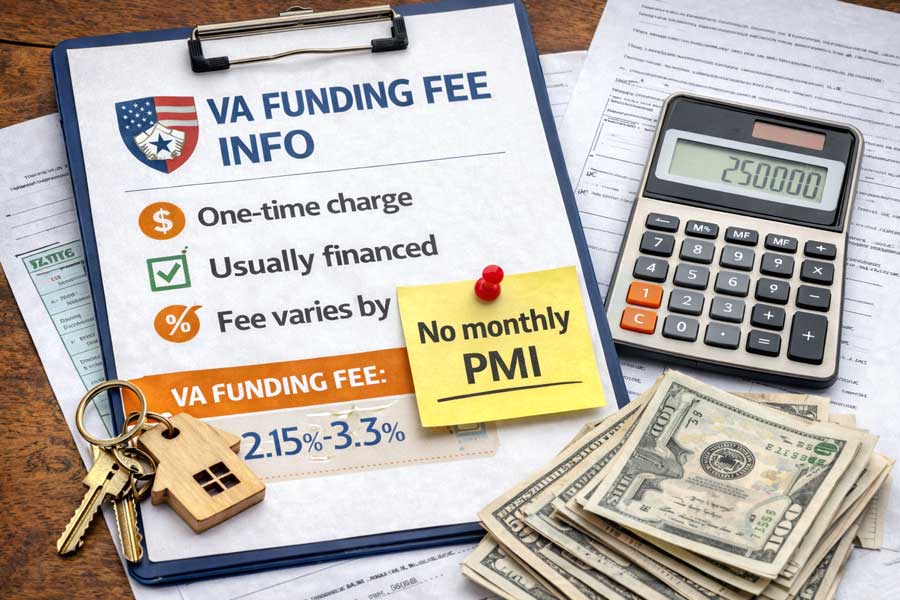

- $0 down payments

- Lower interest rates

- No monthly mortgage insurance

Full VA Entitlement (Most Hawaii Buyers)

You typically have full entitlement if:

- You’ve never used your VA loan benefit, or

- Your previous VA loan was paid off, and entitlement was restored

With full entitlement:

- No loan cap

- No down payment required (even above county limits)

- VA jumbo loans are allowed

Partial Entitlement

You may have partial entitlement if:

- You still own a home with a VA loan, or

- A prior VA loan wasn’t fully paid off

In this case, county loan limits matter and may trigger a down payment.

VA County Loan Limits in Hawaii (2026)

Hawaii is considered a high-cost state, so county loan limits are higher than the national baseline.

These limits only matter if you have partial entitlement.

Honolulu County (Oʻahu)

- Used for homes in Honolulu, Pearl City, Kapolei, Kailua, Kāneʻohe

- Higher limits reflect Oʻahu’s elevated home prices

- Many VA buyers still qualify for $0 down with full entitlement

Maui County

- Includes Maui, Molokaʻi, and Lānaʻi

- Median prices often exceed mainland jumbo thresholds

- VA jumbo loans are common and fully allowed

Hawaiʻi County (Big Island)

- Covers Hilo, Kona, Waimea, and surrounding areas

- Lower prices than Oʻahu or Maui, but still above national averages

- Partial entitlement buyers may still need minimal down payments

When a Down Payment Is Required

A down payment is only required if:

- You have partial entitlement, and

- The loan amount exceeds what your remaining entitlement can support

How the VA Guarantee Formula Works

Lenders require the VA to guarantee 25% of the loan.

If your remaining entitlement doesn’t cover that 25%, you make up the difference as a down payment.

Example: Honolulu VA Loan Limit Scenario

- Purchase price: $1,100,000

- Veteran has partial entitlement

- County conforming limit applies

- Result: Small down payment required to meet the 25% guarantee

With full entitlement, the same purchase could be done with $0 down.

What Is a VA Jumbo Loan in Hawaii?

A VA jumbo loan is simply a VA loan above county conforming limits.

Key advantage in Hawaii:

- No PMI

- Often $0 down with full entitlement

- Far more flexible than conventional jumbo loans

Types of VA Loans Affected by Loan Limits

VA Purchase Loans

- Primary residence only

- Most Hawaii buyers qualify with $0 down

VA Cash-Out Refinance

- Loan limits may apply if entitlement is impacted

VA Streamline Refinance (IRRRL)

- Loan limits rarely matter

- Simplified refinance process

Common VA Loan Limit Myths

❌ “VA loans have a hard cap.”

❌ “You can’t buy expensive homes in Hawaii with VA loans.”

❌ “Jumbo loans require 20% down.”

✔ Reality: With full entitlement, VA loans remain one of the most powerful tools for Hawaii veterans.

Do VA Loan Limits Matter in Hawaii?

For most veterans, VA loan limits in Hawaii don’t matter at all.

What does matter:

- Your entitlement status

- County pricing trends

- Working with a lender who truly understands Hawaii VA loans

Before you move forward, it helps to get personalized VA loan guidance from someone who works with Hawaii veterans every day.

Your Trusted Hawaii VA Loan Specialist

Always putting clients and their families first.

Elias is a local Honolulu VA loan officer dedicated to helping service members and veterans secure Hawaii VA home loans with clarity and confidence.

Whether you’re buying your first home, navigating VA loan limits, or exploring jumbo VA options in high-cost areas like Oʻahu or Maui, you’ll get:

Fast Certificate of Eligibility (COE) support

Clear, step-by-step VA loan guidance

Competitive VA rates tailored to Hawaii’s market

If you want straightforward answers and expert insight from someone who understands Hawaii VA loans inside and out, connect with a specialist who puts your goals first.

Call (808) 517-6416 to speak with a Hawaii VA loan specialist

Take the next step toward owning a home in paradise today!