The VA funding fee is a one-time cost that helps keep the VA loan programs running. It can usually be financed into the loan, and many veterans are fully exempt. For Hawaii buyers, understanding how it works can save thousands upfront.

VA Funding Fee Explained

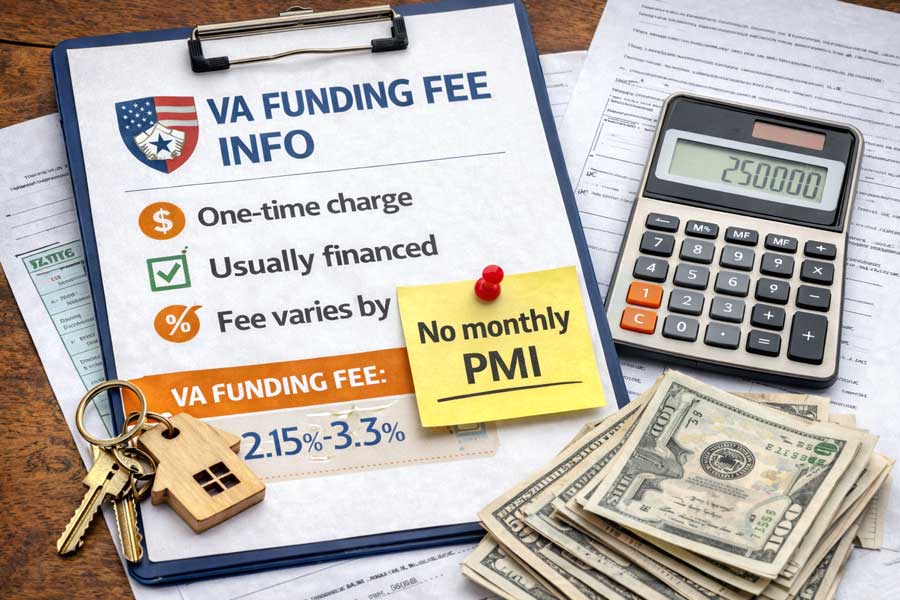

- The VA funding fee is a one-time charge, not monthly

- It helps fund the VA loan program (no PMI required)

- Most buyers finance it into the loan

- Many veterans are 100% exempt

- The fee varies by down payment and VA loan usage

- In Hawaii, financing the fee often makes sense

Key Takeaways

- The VA funding fee is a one-time cost

- Many veterans are fully exempt

- Most buyers finance it into the loan

- It replaces costly monthly PMI

- Personalized analysis beats assumptions

VA Funding Fee Explained: What Veterans Need to Know

The VA funding fee is one of the most talked-about and most misunderstood parts of using a VA loan. For many veterans buying in Hawaii, the fee sounds intimidating at first, especially given higher home prices. But once you understand how it works, it often becomes far less concerning.

Let’s break it down clearly, without lender jargon or pressure.

What Is the VA Funding Fee?

The VA funding fee is a one-time fee charged on most VA loans. Its purpose is simple:

It helps keep the VA loan program running without requiring monthly mortgage insurance.

That’s one of the biggest reasons VA loans remain such a powerful benefit.

How Much Is the VA Funding Fee?

The funding fee is calculated as a percentage of the loan amount and depends on:

- First-time vs repeat VA use

- Size of down payment (if any)

- Loan type (purchase, refinance, etc.)

For most first-time buyers with $0 down, the fee is typically just over 2% of the loan amount.

The key: this fee is not paid monthly and is often rolled into the loan.

Can the VA Funding Fee Be Financed?

Yes — and this is where many Hawaii buyers find relief.

Most veterans choose to:

- Finance the funding fee into the loan

- Avoid bringing extra cash to closing

- Preserve savings for reserves or moving costs

In a higher-cost market like Hawaii, this strategy often makes financial sense.

Who Is Exempt From the VA Funding Fee?

Many veterans are completely exempt from paying the VA funding fee, including:

- Veterans with service-connected disabilities

- Veterans receiving VA disability compensation

- Certain surviving spouses

If you’re exempt, the funding fee is waived entirely — even if it shows up on early estimates.

How the VA Funding Fee Compares to PMI

This is a critical comparison.

| VA Loan | Conventional Loan |

|---|---|

| One-time funding fee | Monthly PMI |

| Often financed | Paid every month |

| No PMI ever | PMI until equity reached |

Over time, the VA funding fee often costs far less than PMI.

VA Funding Fee Myths (Debunked)

“The VA funding fee makes VA loans expensive.”

Not true — especially compared to PMI.

“You must pay it out of pocket.”

Most veterans finance it.

“Everyone has to pay it.”

Many veterans are exempt.

How the VA Funding Fee Fits Into Total Closing Costs

The funding fee is separate from standard closing costs, but it plays a big role in overall affordability.

That’s why it’s best reviewed alongside:

- Escrow and title costs

- Seller credits

- Lender fee caps

A full cost breakdown gives the clearest picture.

Helpful Tools for VA Buyers

These tools help turn estimates into real numbers.

Final Thoughts for Hawaii Veterans

Hawaii’s high home prices can make any added cost feel overwhelming at first. But the VA funding fee is designed to protect veterans long-term, not burden them. When you understand how it works — and whether you’re exempt or able to finance it — it becomes just another manageable part of the process.

With clear information and experienced VA loan guidance, most veterans find that the funding fee is far less of an obstacle than they expected — and owning a home in Hawaii remains well within reach.