VA home loans are one of the most valuable benefits offered to U.S. service members and veterans, thanks to features like no down payment, no private mortgage insurance (PMI), and competitive interest rates. However, there are situations in which VA financing isn’t available or isn’t the best fit—for example, when a borrower has already used their VA entitlement, is looking at an investment property (VA loans require owner‑occupancy), or needs to include a non‑veteran co‑borrower. In those cases, it’s useful to understand alternative financing options.

Why Look Beyond VA Loans?

Veterans sometimes find themselves in situations where VA benefits are unavailable or not ideal. As Veteran.com notes, some borrowers may want to purchase a home without using their VA entitlement because they already own a property or plan to preserve their VA benefit for a future purchase. Others might be seeking a loan for a property that doesn’t meet VA requirements—such as an investment property or a home ineligible for VA appraisal—or they might have credit issues that make VA approval difficult. Alternate financing options can bridge these gaps and still offer competitive terms.

FHA Loans

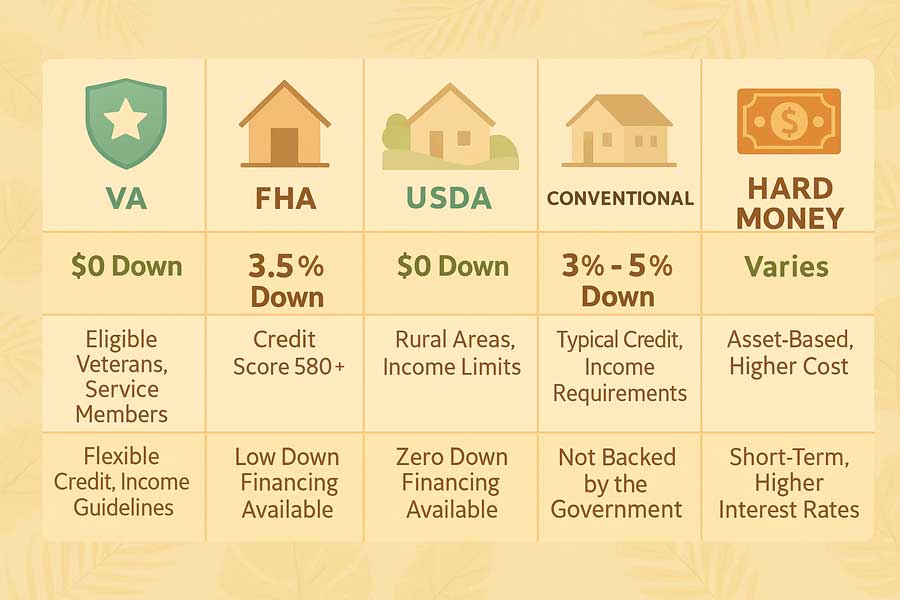

The Federal Housing Administration (FHA) loan is a government‑insured mortgage designed to help borrowers with modest savings or credit challenges. For veterans who lack full VA entitlement or have credit scores that don’t meet VA lender thresholds, an FHA mortgage can be a strong alternative. Key features include:

- Low down payment: FHA loans require as little as 3.5 % down for borrowers with credit scores of 580 or higher.

- Flexible credit standards: FHA guidelines are generally more forgiving for lower credit scores.

- Mortgage insurance premiums (MIP): Unlike VA loans, FHA mortgages have both an upfront and annual mortgage insurance premium. This adds to monthly costs, but it’s a trade‑off for easier qualification.

- Co‑borrower flexibility: FHA loans allow non‑veteran co‑borrowers who are not required to occupy the property. This can help veterans qualify based on combined income.

FHA loans are particularly useful when VA entitlement is exhausted or when a borrower’s credit score is too low for VA underwriting. However, the higher long‑term cost of mortgage insurance should be considered when comparing overall affordability.

USDA Loans

The U.S. Department of Agriculture (USDA) mortgage program offers another zero‑down option for qualifying borrowers. Like VA loans, USDA mortgages require occupancy and provide a government guarantee, which helps keep interest rates low. Important points to note:

- Zero down payment: USDA loans provide 100 % financing for eligible borrowers.

- Rural property requirement: Homes must be located in USDA‑approved rural areas, although many regions near cities still qualify.

- Income limits: USDA borrowers must meet household income caps, so higher‑earning veterans may be ineligible.

USDA loans are ideal for buyers in rural or semi‑rural areas who meet income guidelines. They offer similar benefits to VA loans (no down payment, low rates) but are not suitable for urban properties or high‑income households.

Conventional Loans and VA‑Like Programs

Conventional mortgages are offered through banks, credit unions and mortgage lenders without government backing. For veterans seeking a loan structure similar to VA financing without using their VA entitlement, some institutions have designed specialized programs. Veteran.com highlights the Navy Federal Credit Union’s Military Choice Loan, which provides features such as no down payment, a fixed interest rate and lender‑paid PMI. These VA‑like conventional loans can be attractive when VA eligibility has been exhausted or when purchasing a property not approved for VA financing.

Conventional loans more broadly may require higher down payments (often 3–20 %) and have stricter credit requirements. However, they can be used for investment properties or second homes, which VA and FHA loans generally prohibit. It’s important to shop around, as terms vary widely by lender.

Bank Statement Loans (Stated‑Income Mortgages)

For self‑employed veterans or those with irregular income, bank statement loans—also known as stated‑income mortgages—offer a way to qualify without traditional W‑2 forms. These loans rely on bank statements showing deposits over 12–24 months to verify income. While not exclusive to veterans, they can help borrowers finance properties that are ineligible for VA loans, such as investment homes or vacation rentals.

Because lenders take on more risk, bank statement loans often come with higher interest rates and larger down‑payment requirements. Borrowers should weigh the flexibility against the potential cost and carefully review the loan terms.

Hard Money Loans

Some real estate investors and developers turn to hard money loans when they need short‑term capital quickly. Unlike traditional mortgages, these loans are secured by the property itself rather than the borrower’s creditworthiness, which allows for faster approval. Hard money lending is typically a last‑resort or bridge financing option used in situations where speed is more important than cost.

Key characteristics of hard money loans include:

- High interest rates: Rates often range between 10 % and 18 %, reflecting the higher risk to private lenders and making the financing more expensive than standard mortgages.

- Short repayment terms: Borrowers usually have six to 18 months to repay the loan, so these loans function as a bridge until the property is refinanced or sold.

- Low loan‑to‑value ratios: Hard money lenders generally loan 65 % to 75 % of the property’s value, which means borrowers must have significant equity or a large down payment.

- Less regulation: These loans are offered by private individuals or companies rather than banks, and they are subject to less oversight.

While the speed of funding and the focus on collateral over credit can be advantageous, the high cost and short term make hard money loans unsuitable for most home buyers or owner‑occupied properties. Veterans considering this option should recognize that it is designed primarily for investors who intend to renovate and quickly resell a property, and they should compare the total costs carefully before proceeding.

State‑Based Veterans’ Home Loan Programs

Several U.S. states offer home‑loan programs tailored to veterans. For example, the Mississippi Veterans Home Purchase Board buys homes and resells them to qualifying veterans at lower interest rates, potentially saving thousands of dollars. Other states—such as Alaska, California, Nevada, New York and Texas—operate similar programs. These loans usually require the veteran to occupy the property and may include down‑payment assistance or reduced fees. Availability and terms vary by state, so veterans should check their state’s veterans affairs or housing agency for details.

Comparing Your Options: Questions to Ask

When exploring alternate financing, it’s critical to understand the differences in costs and terms. Veteran.com advises asking lenders pointed questions such as:

- Early‑payoff penalties and balloon payments: Are there penalties for paying the loan off early or making extra payments?

- Mortgage insurance requirements: Does the loan require PMI or MIP, and how much will it add to the monthly payment?

- Occupancy and rental rules: Can you rent out unused units or use the property as an Airbnb? VA and FHA loans have strict occupancy rules.

By comparing these factors—including down‑payment requirements, interest rates, credit standards and property restrictions—you’ll be better equipped to choose the financing option that aligns with your goals.

Final Thoughts

VA home loans remain an outstanding benefit for veterans, but they aren’t the only path to homeownership. FHA loans provide flexibility for those with lower credit or limited savings. USDA loans extend zero‑down financing to rural areas. Specialized conventional programs like Navy Federal’s Military Choice Loan mimic VA benefits without using entitlement. Bank statement loans serve self‑employed borrowers or those seeking investment properties. And state‑based veteran programs can offer unique savings. Exploring these alternatives, asking the right questions, and working with a knowledgeable loan officer will ensure you select the financing solution best suited to your financial situation and long‑term goals.